CommentsHOUSING CRISIS - The US Housing Market is going nuts over the last year. Inventories are near record lows while price appreciation is near record highs.

All in the midst of a deep global recession. These seemingly conflicting realities – a surging housing market and depressed economy – have left many people scratching their heads and asking: How is this Possible?

Well, mainstream media and finance has stepped up with an explanation! The common narrative is now that the US is facing, and has been facing, an epic housing shortage. Some argue that the US is short 4 million homes, while others say that this shortage will last years.

The accepted narrative of a structural shortage in housing has soothed many who were worried that the US is in a housing bubble. Others remain more skeptical.

But here’s the trouble: the notion of a shortage in US housing is an absolute MYTH. In fact, the reality is quite the opposite: the US is starting to experience a sharp decline in the demand for housing.

And this unavoidable decline will have ramifications for the real estate market of the future.

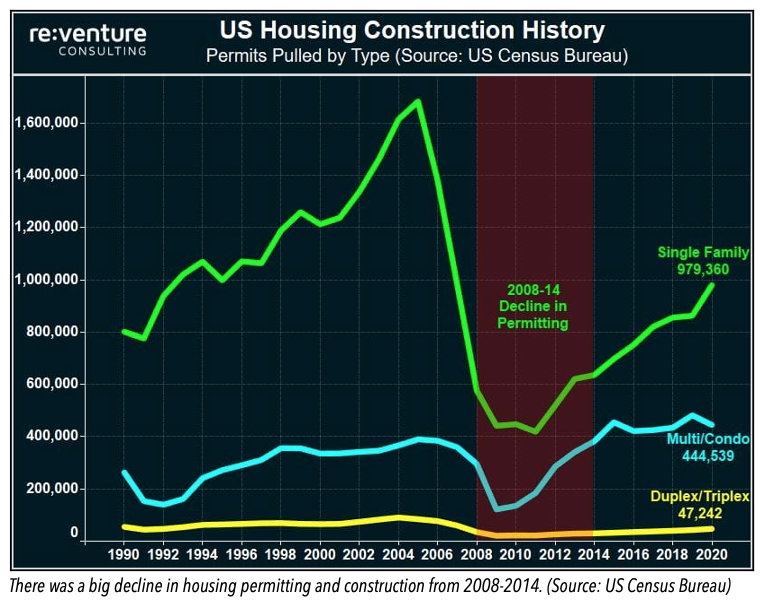

Analyzing the Housing Shortage Argument: In order to understand why the Housing Shortage argument is wrong, we first must need to understand where it comes from. When most mainstream media pundits refer to a shortage, they are likely referencing the decline in home construction that occurred after the Great Financial Crash from 2008-14. Permits for single-family homes declined from a peak of 1.7 million in 2005 all the way down to 400k in 2010, a massive 70% decline. Similarly, permitting for larger multifamily and condo buildings (5+ units) was cut in half over the same period.

It’s been a slog to get permitting, especially for single-family homes, back to previous levels. Many claim that the 1 million SF permits pulled in 2020 is still well below what the country needs to address the shortage created after the housing crash.

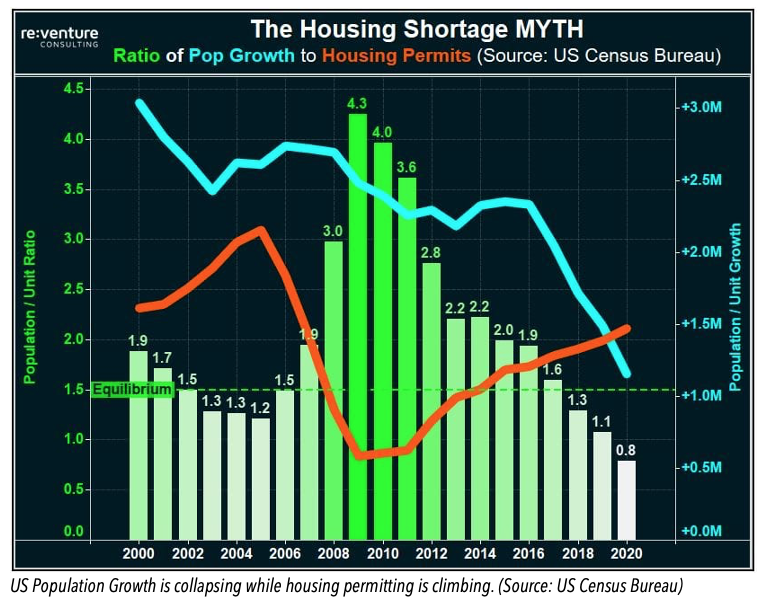

I certainly understand how this looks bad. The drop off in the green line in the graph above is pronounced, and to most this would seem to confirm all the conjecture about a long-term shortage in homes. But there are two sides this to coin – supply, and demand. The permitting situation only talks about supply.

But the true answer lies in demand.

Declining Births, Increasing Deaths: The US is aging. And fast.

What’s behind this shift? The Baby Boomers. This cohort of 75 million people born between 1946 and 1964 is the largest generation in US history. And now they’re starting to get old. And with age come two things: 1) infertility and 2) death.

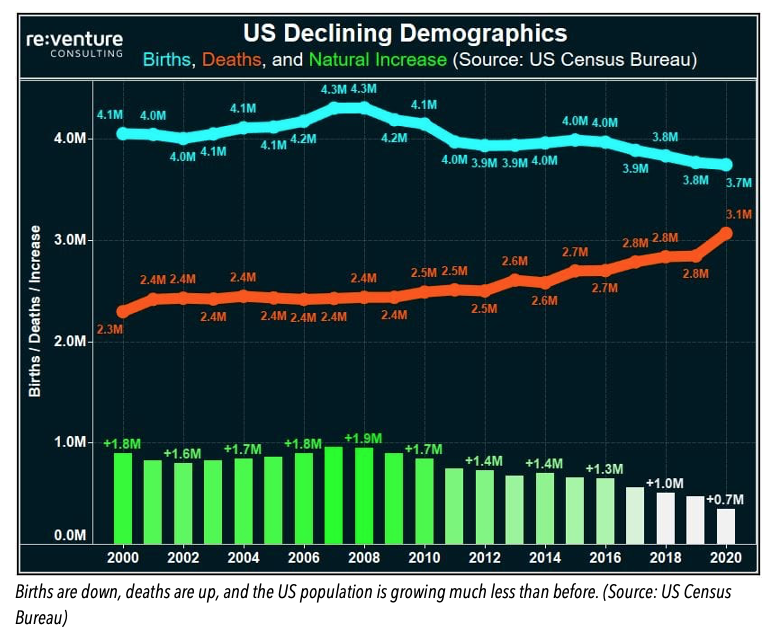

The aging US population, to go along with increased education and wealth, is resulting in lower fertility rates. The net result is a decline in births – the blue line in the graph above. For much of the 2000s the US registered 4.0-4.3 million births per year. That figure has since declined to the 3.7-3.9 million range in recent years.

At the same time, the number of deaths has spiked considerably. Back in the mid-2000s the US was seeing about 2.4 million deaths per year. Now that number is round 2.8-3.1 million, although the 2020 figures were slightly inflated due to COVID.

What happens when births go down and deaths go up? The Natural Increase in population – births minus deaths, the green bars – slows considerably. The US has gone from adding from 1.7-1.9 million people per year through Natural Increase to fewer than 1 million each of the last two years.

This is bad news for the US Housing Market in two ways. First: babies are one of the biggest drivers of home demand, since a family with children prioritize the space and security that home ownership provides. Less births means less of an incentive for couples to buy or upsize. Second: deaths eliminate existing demand from the housing market and will increase the supply of homes on the market for sale.

Unfortunately, this trend is just beginning. The oldest Baby Boomers are 75 while the youngest are 56. Over the next 10 years expect America’s death figures to surge as the Baby Boomer cohort really starts to age. Meanwhile, births are likely to continue their steady decline as more and more couples prioritize career and financial security over children.

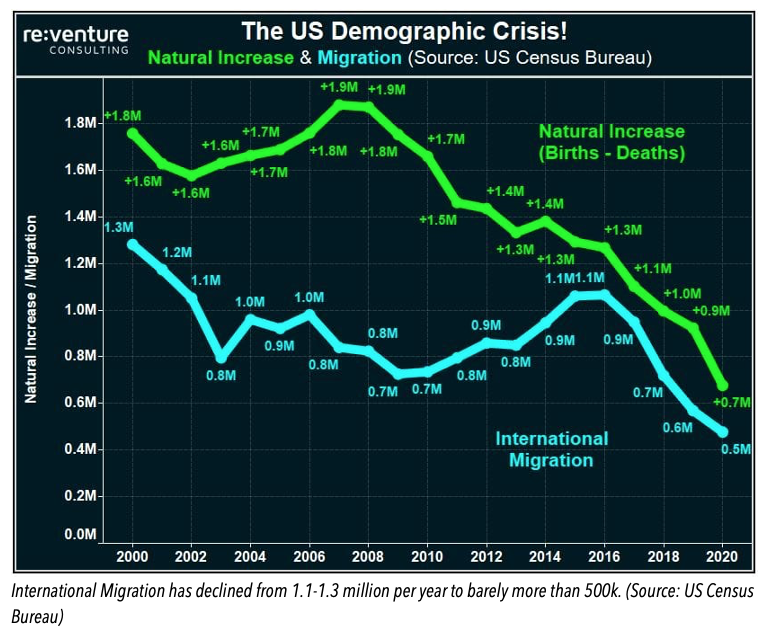

Oh Yeah, Migration is Declining Too: But Natural Increase isn’t the only way the US can add population, and subsequently, demand for homes. The other is through International Migration (which I will also refer to as Immigration). After all, America is one of the most desirable places in the world to live, and millions of people would jump at the chance of move to America and buy/rent a home.

The trouble is that International Migration, like the Natural Increase, has also been on a steady decline over the last two decades.

Immigration was solidly above 1 million per year in the early 2000s. But it’s been on a steady decline since (outside of a brief spike from 2014-16), reaching lows of 500-600k over the last couple years. This decline in Immigration likely stings the real estate market even more than the Natural Increase decline in the short-term, since people who move to this country need a place to live immediately.

It will be interesting to see what happens with International Migration in the future. Some suspect that Donald Trump’s ascendency deterred Immigration, and perhaps a new presidential administration with Joe Biden will result in more new entrants.

Although it’s difficult to predict the future, I would be skeptical of Immigration bouncing back any time soon for two reasons. The first is the COVID pandemic, which has frozen the world in place and resulted in record declines in new immigrant VISA issuances by the US Government. The second is the current US Recession, which has cost the country roughly 8 million jobs since its onset in February 2020. It would be a difficult political move to prioritize new immigration when so much of the domestic economy is out of work.

The Net Result: the US Housing Glut? Declining births, increased deaths, and less International Migration have combined to crater US Population Growth (blue line below) over the last five years. Once a figure that registered around +2.5 million annually, it collapsed to barely over +1 million in 2020.

At the same time, permitting and construction of new homes and apartments (orange line below) is picking back up. So much so that permitting of new housing units exceeded US population growth in 2020! This is the first time in recent history that this has happened.

What you really want to pay attention to are the Green Bars – they measure the ratio of Population Growth to New Housing Permitting in the US. The higher this figure is, the more pent up demand is being created for real estate. The lower the figure? The more supply is being delivered relative to people being gained.

An equilibrium Population / Permitting ratio is about 1.5, meaning 1.5 people added for every 1 permit (equilibrium is above 1 because not every new person needs their own home or apartment).

In the mid-2000s, right before the last housing crash, the Population / Permitting Ratio dipped below 1.5. This signaled that too many new homes and apartments were building built relative to how many people were being added to the US population. Sure enough, the Housing Market crashed shortly thereafter.

Lo and behold – since 2018 the US is back below that 1.5 marker. Especially so in 2019 and 2020, when Population / Permit Ratio measured 1.1 and 0.8, respectively. To repeat – that 0.8 figure in 2020, which means more units were permitted than population grew, is a first in US history.

The Future of the US Housing Market? These are extremely concerning figures for the US Housing Market. And they directly contradict the notion that there is a vast shortage of homes in America.

The simple reality is that the US is aging, and with that comes less growth, and a decreased need for new housing. At the same time, local economic issues along with the COVID pandemic are likely to keep international migration low for the short to intermediate term. This further dampens the need for new housing.

So, the next time someone tries to convince you that the run up in the US housing market is due to a systemic shortage in housing, share this article with them. The demographic trends are undeniable, and they will only get worse.

(Nick Gerli is a consultant with RE: Venture Consulting)