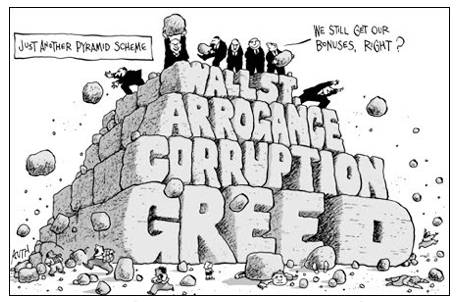

CommentsREMEMBER ENRON?--Los Angeles’ escalating housing costs are not due to impartial market forces, but rather, the product of judicially sanctioned corruptionism. Hillel Aron and Jason McGahan, in their November 29, 2017 article, What Happens When Wall Street Is Your Landlord? describe the personal pain and suffering that is increasingly befalling Angelenos.

As a some CityWatch readers know, the Crash of 2008 began with Countrywide in Los Angeles (technically Simi Valley) when its corrupt mortgage scam spread across the nation. Crime not only pays, but it pays very well. The Crash of 2008 did not end the corruption. Instead, the government gave trillions of dollars to the Wall Street executives who crashed the economy.

After the Crash of 2008, manipulation of the Los Angeles real estate market had a few additional setbacks. One came in 2010 with Governor Schwarzenegger’s veto of AB 2531 which would have “Keloed” all property in Los Angeles, and in 2011 when the State abolished the corrupt Community Redevelopment Agency, effective February 1, 2012.

Then, in January 2014, Judge Alan Goodman horrified the City goniffs by throwing out Garcetti’s Hollywood Community Plan due to its being intentionally based on fatally flawed data and wishful thinking to the extent that it subverted the law (Lies and Myths). Next, in April 2015, Judge James Chalfant cast a dark shadow on corruption by his rejection of the Millennium Earthquake Towers for violating the law which required the City to follow CalTrans’s direction on traffic congestion. The City had substituted its own bogus traffic data in lieu of the CalTrans mandated analysis.

After Judge Goodman’s 2014 Hollywood Plan decision, the City delayed for over two years before issuing the Notice of Preparation [NOP] for the new update for the Hollywood Plan on April 29, 2016. This NOP was based on the Lies and Myths that Judge Goodman had rejected. In addition, Garcetti’s Sustainability PLAn and his Mobility Plan 2035 also mangled the facts and law as did the Environmental Impact Reports [EIRs] for other mega projects such as The Palladium Towers.

Why the City Lies

The City is wedded to Lies and Myths for the simple reason that accurate information would reveal the vast corruption in Los Angeles’ housing market. As detailed by Joel Kotkin and Alan Berger in NewGeography, the City persists in concentrating population density in Transit Districts based on the completely refuted claim that there is a huge demand for high rise apartments in DTLA, Hollywood, South LA, etc. While the unlawful vote trading system at City Council guaranteed unanimous approval of every illicit project, the courts were rejecting those projects. Developers do not give Garcetti’s charity millions of dollars when Judge Goodman or Judge Chalfant court will overturn the City’s approvals.

Judge Richard Fruin – The Developers’ White Knight

On December 13, 2016, Judge Richard Fruin, however, charged to rescue the real estate thieves by ruling that the City was above the law, making the city council’s conduct “non-justiciable.” That’s a highfalutin word meaning, “screw you, corruption uber alles.” In other words, the City Council does not have to follow the law and there is nothing any judge can do about it. (Oh, how Donald Trump’s lawyer would love Judge Fruin to rule that Donny Small Hands is also above the law making his actions “non-justiciable.”)

Previously, in August 2016, Judge Fruin had ruled in SaveValleyVillage v City of LA BS 157989, that the City may conceal documents from the public so that City Planning could make secret decisions. Judge Fruin allowed the City to conceal the report throughout all the administrative hearings and keep it out of the administrative record. Only after the Petitioner had filed its opening brief, then Judge Fruin permitted the heretofore secret report to be sprung upon everyone. Thus, it should have been no surprise when Judge Fruin ruled four months later in December 2016 that the City may make all its decisions in secret without public knowledge despite the requirements of The Brown Act. When City Council approves a project based on a secret vote trading agreement and not on the public facts of the project, the Brown Act has been violated.

The Significant of Los Angeles Housing Corruption

If we were dealing with only a few developers playing the typical penny ante game of “you approve my project, I’ll contribute to your political campaign,” the implications for all of Los Angeles would not be so significant. In fact, if Los Angeles were the sole place where such nefarious conduct would occur, the nation would not be affected. As we saw with the Subprime Mortgage Frauds emanating from Los Angeles’ Countrywide, what happens in Los Angeles does not stay in Los Angeles. When the courts have given the thieves carte blanche to do whatever they want with the unanimous blessings of a city council, other parts of the nation will follow suit. With literally billions of dollars flowing into Wall Street coffers, anyone who thinks that this massive rip off won’t end up devastating the national real estate market does not know the meaning of catastrophic disaster.

For example, Blackstone and its Invitation Homes shows why Judge Fruin had to protect the City’s behavior. Billions of dollars are being invested in massive real estate scams similar to the subprime mortgage frauds.

In South LA this massive shift of wealth from average Angelenos to Wall Street hides under the rubric of Gentrification. This is where the Hillel Aron and Jason McGahan article is outstandingly relevant to all of us.

For example, as shown in the prior issue of CityWatch, Granny Flats are being pushed in order to horrendously aggrandize the mortgages people must carry in order to own a detached home. The beneficiary of these absurdly high mortgages is Wall Street.

Prognosis?

Remember when Enron’s CEO Ken Lay told everyone that Enron was financially sound and urged them to put all their retirement funds into Enron stock? At the same time, he was selling his Enron stock and needed their purchases to conceal his selling. If anyone thinks that Garcetti, or any of developers at Blackstone or any Wall Street investment bankers give a damn about you, remember that Ken Lay urged people to invest their life savings so he could make a few more million before Enron crashed.

(Richard Lee Abrams is a Los Angeles attorney and a CityWatch contributor. He can be reached at: [email protected]. Abrams views are his own and do not necessarily reflect the views of CityWatch.) Edited for CityWatch by Linda Abrams.

-cw