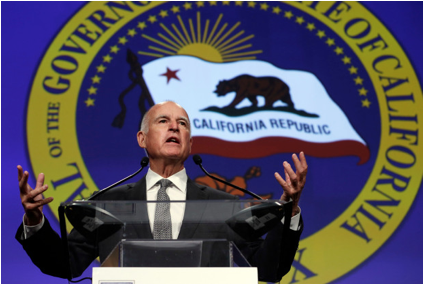

CommentsHOW GOLD IS THE GOLDEN STATE? --Twice each year, once in January and again in May, Gov. Jerry Brown warns Californians that the economic prosperity their state has enjoyed in recent years won’t last forever.

Brown attaches his admonishments to the budgets he proposes to the Legislature – the initial one in January and a revised version four months later.

Brown’s latest, issued last May, cited uncertainty about turmoil in the national government, urged legislators to “plan for and save for tougher budget times ahead,” and added:

“By the time the budget is enacted in June, the economy will have finished its eighth year of expansion – only two years shorter than the longest recovery since World War II. A recession at some point is inevitable.”

It’s certain that Brown will renew his warning next month. Implicitly, he may hope that the inevitable recession he envisions will occur once his final term as governor ends in January, 2019, because it would, his own financial advisers believe, have a devastating effect on the state budget.

A new report from the federal Bureau of Economic Analysis, however, hints that the downturn may have already started.

The BEA releases state-by-state economic data each quarter and its reports for the first and second quarters of 2017 are not good news for California.

Last year was a very good one for the state’s economy. The 3.3 percent gain in economic output in 2016 was more than double that of the nation as a whole and one of the highest of any state.

However, California stumbled during the first half of 2017. California’s increase was an anemic six tenths of one percent in the first quarter compared to the same period of 2016, and 2.1 percent in the second quarter, well below the national rate and ranking 35th in the nation.

The report revealed that almost every one of California’s major sectors fell behind national trends in the second quarter, with the most conspicuous laggard being manufacturing.

The only big California sector showing robust health was “information,” reflecting the unfortunate truism that the Silicon Valley-centered technology industry continues to prop up an otherwise lackluster overall economy.

It may be only a hiccup in California’s $2.6 trillion economy, the fifth or sixth largest in the world were it a nation. But maybe not.

Were the oft-predicted recession to finally hit, the most obvious effect would be on the state budget. It is highly dependent on income taxes paid by a handful of high-income Californians, particularly on their investment gains and particularly in the tech-heavy San Francisco Bay area.

The last recession a decade ago revealed just how that dependency backfires in recession.

The state is even more dependent now, thanks to voter-approved increases in marginal tax rates, so a new recession would have even harsher fiscal effects.

However, the impact would not be confined to the budget. We could see unemployment, which has been at record-low levels recently, skyrocket as it did a decade ago with collateral impacts on housing, retail sales and virtually every other economic activity.

We would also see a new debate over whether California’s high taxes, high labor and housing costs and high levels of regulation have, as critics allege, made the state less attractive to job-creating investment and more vulnerable to recession.

Will it happen? Yes. A recession is inevitable as Brown warns. What we don’t know is when and whether it would seriously impact the high-tech industry. It is so vital to California’s overall economic health that were it to falter, an otherwise mild recession could be devastating.

Dan Walters has been a journalist for nearly 57 years, spending all but a few of those years working for California newspapers. He has written more than 9,000 columns about California and its politics. This Walters perspective originated at CalMatters a nonpartisan, nonprofit journalism venture committed to explaining how California’s state Capitol works and why it matters.)

-cw