CommentsEASTSIDER-When I grew up, we had a whole bunch of automakers in the US, mostly based in Detroit. One heck of a lot of jobs, mostly in America. That ended with the full-on onslaught of the Global Economy, which we are told is “good for us” and somehow produces a better free market which should make us all sing hosannas and clap with joy.

I still remember the television pronouncement of President Bill Clinton as he told us all to get over the idea of working for one employer and retiring on their pension. We lived in the new, competitive, global economy and we needed to get used to it and be willing to train, and retrain, for a bunch of different jobs during our working life so that we too, could become competitive. Or some such horsepuckey.

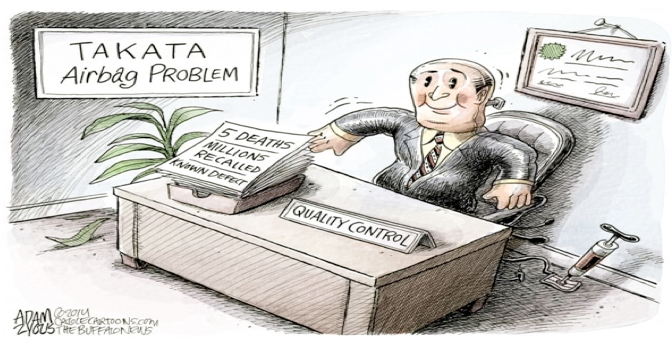

So here’s my poster child for “how’s that workin’ for ya?” Let’s talk about airbags. You know, the ones that are in virtually every car these days, made overseas by the Takata Corporation, a veritable shining example of global competitiveness and its outcomes.

These devices were so cost competitive on a per unit basis that they created close to a monopoly: no one else could compete with their prices. After all, if car companies can save a few cents per unit on every car they make, then they should do so. Then add all that up and “hurrah” – it’s a shining example of global competitiveness in action.

But it is also a prime example of what happens when a system goes wrong. The simple timeline of the airbag problem and efforts to fix it shows us how incapable our system is in actually dealing with global problems of this magnitude. Here’s Consumer Reports’ take on it.

And this gift just keeps on giving. I own a Toyota and was overjoyed to be greeted by this headline last week: “A second airbag supplier SNAFU hits Toyota, 1.4 million cars recalled.”

Seems to me that all this points out some pretty serious flaws in the wonderful “global economy” theory. When things go wrong, no one knows the magnitude of the problem for a long time because the chain of how it has occurred is murky, complex, and has happened over a long period of time. The company on the hook is simply unable to fix the problem for every vehicle, because, in truth, doing that all at once would make them go bankrupt. So too bad for all of us and our cars. But we still go through these tortured exercises about how the government is somehow responsible for figuring out what to do. It’s a huge mess and coping with it is beyond the ability of any one of these global giants. Plus, the car manufacturers can’t take the hit all at once either.

Remember, one of the upsides of the old “inefficient” economy was a certain amount of redundancy. There were usually a fair number of parts manufactured so that, if one messed up, there were quick fixes or alternatives. In fact, often a manufacturer would step up and actually make the part if necessary. Our global system, in contrast, tends to rely on a “just in time” assembly process with pieces coming on a slow boat from China. The old system had the advantage of redundancy, as well as being close to home -- and oh, by the way, providing jobs for us.

The financial services industry could care less about this because they are the primary beneficiary of the global economy. They’ve already taken in their money and have it lodged in institutions all around the world, able to move their profits at the click of a button at the speed of electrons.

By financing these deals with a massive amount of highly leveraged debt, they have made tons of money which they and their corporate partners can hide overseas to evade US taxes. If one of the deals goes bad, some investors (like your and my 401-k plans) get hit. However, the corporate types along with their profits have moved on, bearing no responsibility.

In the meantime, people die. Also, a heck of a lot of folks in the United States have lost their jobs, with most of the manufacturing losses permanent. There is a direct correlation between the so-called free trade deals and job losses for us, and it’s not based on news media hype. Even the New York Times gets it.

If you want to really know the details, check out the 55-page research paper referred to in the Times article here.

Where does all this leave you and me? How about we consider less globalization and more local jobs? How about actually reigning in “Too Big to Fail” banks? Of course, I wouldn’t hold my breath with the two presidential candidates we have, but I can dream, can’t I?

(Tony Butka is an Eastside community activist, who has served on a neighborhood council, has a background in government and is a contributor to CityWatch.) Edited for CityWatch by Linda Abrams.

Sidebar

Our mission is to promote and facilitate civic engagement and neighborhood empowerment, and to hold area government and its politicians accountable.

CityWatch Los Angeles

Politics. Perspective. Participation.

CityWatch Los Angeles

Politics. Perspective. Participation.

04

Wed, Mar