CommentsEASTSIDER-I don’t mean to keep harping on Airbnb, but this company’s sophistication in maximizing profits to pay off its owners and venture capital partners (as opposed to LA City’s pathetic attempts to regulate almost anything) makes it imperative that we get the new short-term rental ordinance right.

So let’s see if we can help the City as they huddle in the bowels of City Hall trying to come up with a plan. The real key to enforcing anything is to have an accurate and timely reporting system for both Airbnb and the City. It’s not as if Airbnb can’t comply -- this is a company currently valued at over $20 billion, whose last round of financing was around a billion, give or take a few hundred million.

At the same time, thanks to a diligent reader, I have discovered that their reporting of what goes on in a rental between host and client is “interesting,” to say the least. For example, it turns out that according to their own documentation, Airbnb only issues a 1099 for their hosts if they had over 200 transactions and earned over $20,000. Wow.

If you scroll around the Airbnb website, you’ll see a bunch of weasel words that make it unclear as to whether or not Airbnb actually does require tax withholding; there is a caveat stating that, “If you received a request to submit your taxpayer information and haven’t provided it yet, we’re required to withhold 28% from your payouts and remit the withholdings to the Internal Revenue Service in Washington, DC. You can avoid this by submitting your taxpayer information.”

From the meetings in Los Angeles, we also know (at least as of the last time anyone checked) that they scrub their website after an individual transaction is complete; there’s no electronic paper trail to know exactly who hosted what for how much and for how long. Understand that this doesn’t mean the information isn’t stored elsewhere. (By the way, if anyone knows differently, please let me know at [email protected]. It’s important to be accurate.)

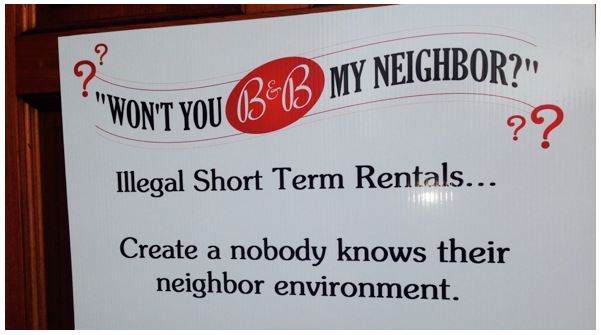

According to folks in the neighborhood, people cannot readily obtain information about who the real owners are of properties being rented out by these “Hosts.”

Therefore, it seems essential that when the City considers an Ordinance, it must come up with a viable record keeping system that is verifiable. At a minimum, it should include:

1) Property Address

2) Name, address, and email of the Host

3) Name and address of the Property Owner

4) Name and address of the Guest(s)

5) Duration of the stay

6) Fees collected

7) Particulars as to how long Airbnb will maintain these records, and at what intervals they will be provided to LA City for calculation of fee purposes.

Remember, while Airbnb is running around like Uber on steroids, there are a lot of issues involved in a property transaction that go way beyond that of a taxi ride. For example, in the event of an accident, who’s on the hook? If the property doesn’t meet basic code requirements, like ADA minimums, can it still be rented? And again, who’s on the hook if something goes wrong?

If renters are all in for a “party house hosting event,” what happens if they party hearty, jam the streets, get drunk or loaded, have a seriously loud DJ, sound system, or a band going all night long?

What if you are renting an apartment and discover that next door or on the next floor there’s an obnoxious Airbnb rental in place? What are the limits as to exactly what the City and the City Attorney can legally waive? Are real estate agents obligated to disclose if a property is adjacent to an Airbnb property?

I raise all of these questions because these are concerns raised by people in our neighborhoods. To date, no one from either the City, Airbnb or the Hosts have provided any answers.

In late breaking news -- hat tip Jane Teis -- there is a new lawsuit in New York challenging Airbnb’s entire business model, claiming that Airbnb is in fact an unlicensed real estate broker. Whether this is an attention getting scheme or a legitimate challenge to their business model remains to be seen.

(Tony Butka is an Eastside community activist, who has served on a neighborhood council, has a background in government and is a contributor to CityWatch.) Edited for CityWatch by Linda Abrams.