CommentsLA WATCHDOG--The City of Los Angeles is hemorrhaging cash. So why are Mayor Eric Garcetti and the City Council entering into deals that are providing almost $1 billion of tax breaks for projects that already have excellent rates of return for their deep pocketed investors?

The City’s finances are a mess despite a booming economy that has fueled a 31%, $1.4 billion increase in tax revenues.

Next year, City Hall is anticipating a budget gap of almost $250 million even with a bump in revenues of over $100 million. This shortfall includes an increase in required pension contributions and generous raises for the police and the City’s civilian workers.

The City’s Structural Deficit means we are looking at a river of red ink for years to come as our Elected Elite are unwilling to hold the growth in personnel expense to levels that do not exceed the growth in revenues. And this perennial shortfall does not include any additional funding to address the City’s $10 billion deferred maintenance backlog or the $15 billion unfunded pension liability.

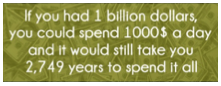

The City’s Annual Report disclosed that the City entered into six Development Incentive Agreements in 2017 that called for $850 million of tax abatements. And since that time, the City has also entered into at least two other transactions for $126 million in unneeded tax breaks, increasing the grand total to almost $1 billion.

This total does not include the 28 new Mills Act contracts for historic properties.

Of the eight deals, six involve the City’s efforts to have 8,000 rooms within walking distance of the Convention Center. These resulted in tax breaks of almost $750 million for around 3,700 rooms.

The beneficiaries were LA Live/Convention Center Hotel (1,001 rooms), 901 Olympic North (393 rooms), Metropolis (350 rooms), the Wilshire Grand (560 rooms), Pico + Figueroa (1,130 rooms), and the Cambria (247 rooms) on James Wood Boulevard.

However, a closer review of the documents prepared by the consultants indicate that the operators of these Convention Center hotels do not need the tax breaks to earn a very nice return on their investments. The only exception may be the LA Live/Convention Center Hotel where AEG was the pioneering investor in this area, having ponied up almost $4 billion in this previously undesirable part of the City.

The City is also considering investing $500 million in the expansion of the Convention Center which will provide additional benefits for the real estate developers and hotel operators.

The City is also subsidizing the developers of the Grand Avenue Hotel project to the tune of $200 million over the next 25 years. This development includes a hotel as well as residential, commercial, retail, and entertainment components, all of which will provide the developer and its investors with a very nice return without the subsidies.

The City is also subsidizing the developers of the Grand Avenue Hotel project to the tune of $200 million over the next 25 years. This development includes a hotel as well as residential, commercial, retail, and entertainment components, all of which will provide the developer and its investors with a very nice return without the subsidies.

And then the City is providing subsidies of almost $50 million to Westfield Corporation for its Village at Westfield Topanga, a highly profitable add-on development to its existing properties that are near Warner Center in the West Valley.

Incidentally, Westfield has entered into an agreement with a French real estate operator to be acquired for $16 billion.

The Mayor and the City Council are a soft touch for real estate developers and hotel operators. City Hall has bought the argument that limiting tax breaks to 50% of the increase in City revenues over a 25 year period is a great deal, even if the real estate developers and the hotel operators are making a fortune before any subsidy.

In recent giveaways, the real estate developers and hotel operators are front loading their subsidies where they get 80% of the increase in City revenues for the first eight to ten years, usually an amount equal to the 14% hotel tax.

IF the City is to continue with its Development Incentive Agreements, and that is a big IF, then the program must be restructured to make sure that a tax break is necessary for a project to make economic sense. Furthermore, if the City subsidizes a successful project, the City should participate in the upside by requiring the developer to repay the subsidy (call it a loan) plus interest plus a bonus based on the level of profitability.

In other words, there is no free lunch.

What would this $1 billion of giveaways buy the City? How a many miles of D and F streets would be repaired? How many more cops would be on the streets? And what about permanent supportive housing for the homeless? There may even be money left over to finance Jose Huizar’s pet project, the 4 mile, $300 million Los Angeles Streetcar.

(Jack Humphreville writes LA Watchdog for CityWatch. He is the President of the DWP Advocacy Committee and is the Budget and DWP representative for the Greater Wilshire Neighborhood Council. He is a Neighborhood Council Budget Advocate. He can be reached at: [email protected].)

-cw