CommentsLA WATCHDOG--Why has Councilmember Paul Krekorian, the Chair of the Budget and Finance Committee of the Los Angeles City Council, refused to address the massive unfunded pension liability of the City’s two pensions funds and the ever increasing annual required pension contributions that will devour the City’s budget and adversely impact the quality of life of future Angelenos?

The City is expected to contribute about $1.1 billion to the City’s two pension plans, the Los Angeles City Employees’ Retirement System (“LACERS”) and the Los Angeles Fire and Police Pension Plans (“FPP”). This represents 19% of the 2017-18 General Fund budget.

To put this in the proper perspective, this $1.1 billion budget line item is triple the pension contribution of $350 million in 2005. This earlier amount represented less than 10% of the 2004-05 General Fund budget.

Rather than spending an additional $850 million on pensions, some of that money may have been used to finance permanent supportive housing for the homeless, eliminating the need for the new tax to support $1.2 billion in bonds that voters approved in November. This money may have also been used to repair and maintain our lunar cratered streets, eliminating the need for a “Street Tax” (referred to as a “new revenue source”) that is being considered by the Mayor and City Council. And the same applies to the “Rain Tax” that would fund the City’s storm water program.

Unfortunately for Angelenos, this $1.1 billion pension expense is understated. If the City assumed a 6% return as suggested by Warren Buffett of Berkshire Hathaway fame and fortune instead of relying on its overly optimistic investment rate assumption of 7½%, the annual contribution would increase by around $500 million. A $1.6 billion line item would chew up 28% of the General Fund budget.

The actuarial unfunded pension liability for LACERS and FPP is $8.3 billion as of June 30, 2016. However, if you eliminate some of the actuarial gymnastics and mark the value of the pension funds’ assets to their real market value, the liability increases to $9.6 billion (77% funded).

And if you use an investment rate assumption of 6½%, the unfunded liability increases to $15.2 billion (68% funded) based on information provided in the actuarial reports.

Moody’s Investors Service, the national credit rating agency, suggested that the unfunded pension liability was over four times that General Fund budget, implying a $23 billion shortfall (59% funded).

With this level of liabilities and ever increasing pension contributions, coupled with the City’s Structural Deficit, how is Moody’s able to support an investment grade rating for Los Angeles when Angelenos are already one of the highest taxed jurisdictions in the country.

During the recent budget hearings, Krekorian was having a cow because the politically appointed trustees of both FPP and LACERS will most likely decide to lower the investment rate assumption to 7¼%, or maybe even 7%. But Krekorian implied that this was a decision that should be made by elected officials since it will involve an immediate budget hit of $80 to $200 million in 2018-19 according to the Chief Legislative Analyst.

However, the decision to lower the investment rate assumption is in line with the recent decision by the California Public Employees Retirement System to lower its investment rate assumption to 7% in light of its projected long term investment return of 6.2%.

Krekorian is a supporter of the status quo as he has not offered any real solutions to the City’s pension crisis.

If Krekorian had the best interests of Angelenos as his first priority, he would follow up on the recommendation of the LA 2020 Commission to establish a Commission on Retirement Security. This temporary organization would review and analyze the City’s two pension plans so that Angelenos, the media, and our elected officials would have a working knowledge of the pension plans and their impact on the City budget. The Commission would also be charged with making recommendations that would alleviate the burden on the City and eliminate the unfunded liability.

But this simple recommendation has not seen the light of day as the politically ambitious Krekorian, along with his fellow Council members and Mayor Eric Garcetti, fear that they may antagonize the campaign financing leadership of the City’s unions.

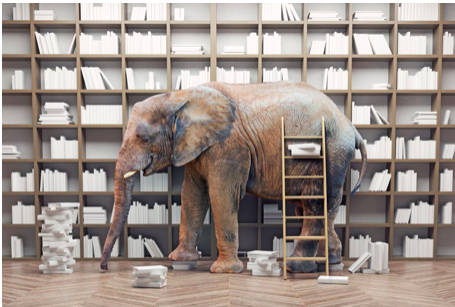

Now is the time for pension reform as the City is engaged in contract negotiations with the leaders of its unions. It is not right that so few are benefitting at the expense of so many Angelenos who in turn are being denied basic services as the pension monster is devouring the City’s scarce resources.

(Jack Humphreville writes LA Watchdog for CityWatch. He is the President of the DWP Advocacy Committee and is the Budget and DWP representative for the Greater Wilshire Neighborhood Council. He is a Neighborhood Council Budget Advocate. He can be reached at: [email protected].)

-cw