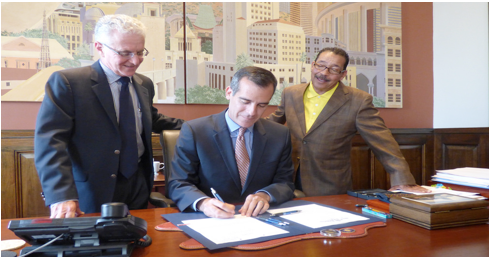

CommentsLA WATCHDOG--Mayor Eric Garcetti, City Council President Herb Wesson, Budget Committee Chair Paul Krekorian, (photo above) and Personnel Committee Chair Paul Koretz all have their heads buried in the sand, ignoring the implications of a $15 billion unfunded pension liability, $1.5 billion in annual pension contributions consuming 30% of the General Fund, and a negative net worth in the its Governmental Accounts.

In April of 2014, the LA 2020 Commission recommended that the City establish a Commission on Retirement Security to “review the City’s retirement obligations in order to promote a better understanding of the facts” and to make “concrete recommendations on how to achieve equilibrium on retirement costs by 2020.”

This blue ribbon commission also recommended that the City “be honest about the cost of future promises” by reviewing the overly optimistic Investment Rate Assumption of 7.5% used by the City’s two seriously underfunded pension plans.

Unfortunately, both these excellent recommendations have not seen the light of day as Wesson, Krekorian, and Koretz have buried them deep in the bowels of City Hall.

Our City’s two pension plans have liabilities of $41 billion and are about 80% funded, leaving an unfunded liability of $8 billion.

The City is also contributing $1.1 billion a year to the two pension funds, representing about 20% of the City’s General Fund, up from less than 10% in 2005. This ever increasing obligation, along with generous increases in salaries and medical benefits, has resulted in less money to repair and maintain our lunar cratered streets and broken sidewalks, to fund affordable housing, and to care for the homeless.

But the unfunded pension liability is seriously understated as it relies on the overly optimistic investment rate assumption of 7.5%. If the this rate was lowered to 6.5%, a rate that still exceeds those used in the private sector and by the federal government, the unfunded liability would jump to $13.5 billion, representing a funded level of slightly more than 70%.

This liability will no doubt increase this year to over $15 billion as the two pension funds will not earn their targeted rates of return of 7.5%.

The lower investment rate assumption of 6.5% will increase the City’s required pension contribution to over $1.5 billion. Of this amount, almost two-thirds of this payment will fund the $15 billion unfunded pension liability, dead money that is devouring the future of our City.

Pension liabilities are also impacting the City’s net worth. As was revealed by Paul Hatfield in his recent CityWatch column, the long overdue accounting rule that now requires the City to carry the unfunded pension liability of the City’s balance sheet resulted in the City having a negative net worth in its governmental accounts, dropping from a surplus on $5.2 billion to a half a billion in the red.

But rather than relying on the City Council, Mayor Garcetti should direct the Los Angeles City Employees Retirement System (“LACERS”) and the Los Angeles Fire and Police Pension Plans and their board members to establish their own Commission on Retirement Security as recommended by the LA 2020 Commission. This would also include a review of the overly optimistic Investment Rate Assumption.

On Tuesday, March 22, the Garcetti controlled Board of Administration of LACERS will meet to approve the City’s contribution to the new Tier 3 pension plan that was established for civilian employees hired on or after February 21, 2016. This replaces the Tier 2 pension plan that was established in 2012 unilaterally by the City Council for new employees that were hired after July 1, 2013, a less risky, money saving alternative that was detested by the leadership of the civilian unions.

This new Tier 3 plan will require our cash strapped City to fork over $14 million to LACERS to finance the return of over 2,000 recently hired civilian employees to the original Tier 1 pension plan. And while the contributions to the Tier 3 pension plan will be lower than those to the original Tier 1 plan, they will be substantially higher than those under the Tier 2, in large part because 50% of the investment risk would have been shared with the employees.

But rather than just focusing on business as usual, Mayor Garcetti should put on his big boy pants and show real leadership by directing his appointees on the LACERS Board of Administration to place these LA 2020 recommendations on the agenda.

Garcetti and the Board should also develop a policy of openness and transparency by reaching out to all Angelenos. This would include City wide meetings and a Pension for Dummies course so that we can get a better understanding of the City’s pension obligations and how they are crowding out basic City services.

Openness and transparency about the City’s seriously underfunded pension plans must surely be an important part of Garcetti’s Back to Basics plan.

(Jack Humphreville writes LA Watchdog for CityWatch. He is the President of the DWP Advocacy Committee and a member of the Greater Wilshire Neighborhood Council. Humphreville is the publisher of the Recycler Classifieds -- www.recycler.com. He can be reached at: [email protected].)

-cw