Comments

STUDENT DEBT - Visualizing the shifting burden of higher education in 2024.

Student loan debt remains one of the most pressing financial challenges in the U.S.—and its weight is carried very differently across generational lines.

Generation Z: Fastest Growth, Youngest Debtors

Generation Z (born 1997–2012) has the lowest average balance at $22,948, but their debt is growing faster than any other generation—at a 6.72% compound annual rate.

Despite their youth, 13.1 million Gen Z borrowers now carry loans, making up 28.2% of all borrowers. Nearly two-thirds make monthly payments under $200, but 84% say debt has delayed key milestones like homeownership or starting a business.

Millennials: Largest Borrower Group, Shrinking Balances

Millennials (born 1982–1996) account for the largest share of all borrowers (39.9%). Their average balance has dropped from $46,281 in 2021 to $40,438 today—a 4.40% annual decline.

Despite this progress, the financial toll remains steep: 83% of Millennials with debt have postponed major life investments, and 42% have foregone further education due to their student loans.

Generation X: Highest Average Debt

Generation X (born 1965–1980) carries the heaviest average student loan burden at $44,240, roughly 17% above the national average. While they make up 30.3% of all student debt, many are parents themselves, often taking out loans for their children's education.

Nearly 30% of Gen X borrowers pay over $500 per month, and 70% report delaying significant life purchases.

Baby Boomers: Fewer Borrowers, Still Owe Big

Boomers (born 1946–1964) represent a shrinking share of borrowers, but those who still carry debt owe a hefty $41,877 on average—the second-highest of all generations. For many, these loans were co-signed for children or obtained later in life.

About 58% have postponed retirement, vacations, or major purchases because of student debt.

Silent Generation: A Lingering Legacy

Even members of the Silent Generation (born 1928–1945) haven’t fully escaped the student loan system. Though they comprise just 1.4% of borrowers, those who carry loans owe $31,106 on average. Their debt has been growing slowly in recent years, often due to Parent PLUS loans.

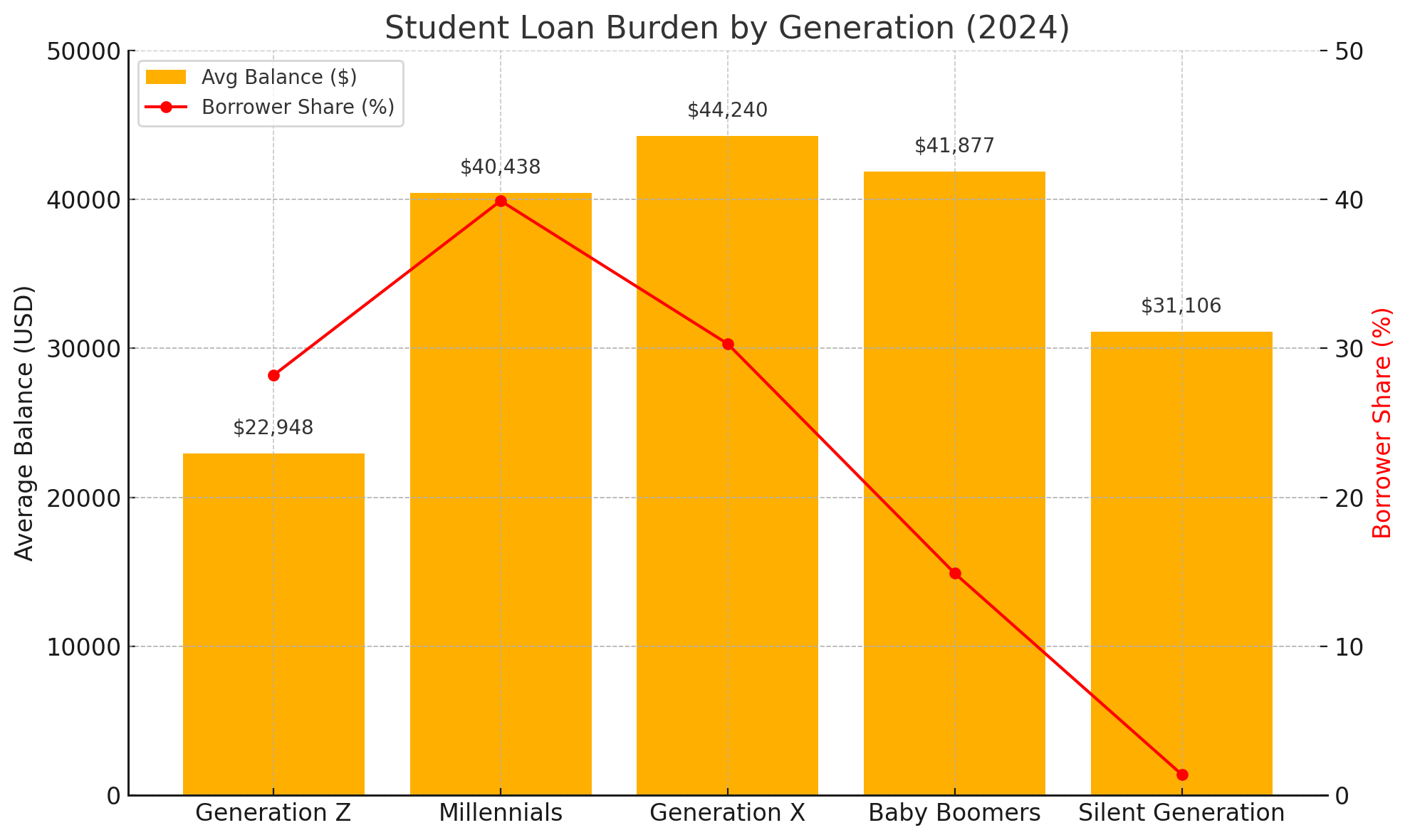

Visualizing the Burden: Loan Balance vs. Borrower Share by Generation

Below is a dual-axis chart illustrating both the average student loan balance and borrower share by generation in 2024:

Key Takeaways

- Gen Z’s debt is growing fastest, though their average balance remains lowest—for now.

- Millennials carry the most debt overall but are paying it down more aggressively.

- Gen X owes the most per borrower, reflecting midlife obligations and parental loans.

- Boomers and Silents still carry debt, largely from helping children fund education.

- Student loan debt is shaping major life decisions—from delaying marriage and home buying to job selection and continued education.

As the debate over forgiveness, repayment reform, and rising tuition costs continues, this generational lens helps clarify who’s being hit hardest—and who’s most at risk in the years ahead.

###