CommentsBITCOIN INSIDER--We all remember the Crypto Singularity of December, 2017. Altcoins and the cryptocurrency market grew enormously with Bitcoin’s price even reaching above the $ 19k mark.

However in a startling price correction, Bitcoin’s price started to fall on December 20th, and by early February it had even gone lower than $ 7k. So what caused it? It was not a bubble, if it had been, the price of Bitcoin would have popped and gone to zero.

More studies and articles seem point to the launch of Bitcoin Futures being to blame.

Bitcoin’s fall from almost USD 20,000 is directly tied to the launch of a futures market, according to research from the San Francisco Federal Reserve, published in May, 2018.

The so called crypto singularity began in earnest at the end of October, 2017 when CME Group, the world’s biggest exchange operator, announced plans to launch bitcoin futures contracts that would give institutional investors exposure to the new asset class. However, the futures hype may have also caused significant changes in Bitcoin’s valuation that crippled some of the public enthusiasm over crypto in subsequent months.

The Real Reason Bitcoin’s Price Lost Half of its Value

According to CNBC:

- Bitcoin’s drop following its peak near $20,000 was directly tied to the launch of a futures market, according to new researchfrom the San Francisco Federal Reserve.

- “The rapid run-up and subsequent fall in the price after the introduction of futures does not appear to be a coincidence,” four researchers say in the regional Fed bank’s recent Economic Letter.

- The cryptocurrency’s highest price lines up with the day the Chicago Mercantile Exchange, or CME, introduced bitcoin futures trading.

Crypto market manipulation by big players seems to have been at work here with the mainstream suppression of Bitcoin hype, that was getting a bit out of control for the business model of more mainstream financial services.

A Little Bit of History

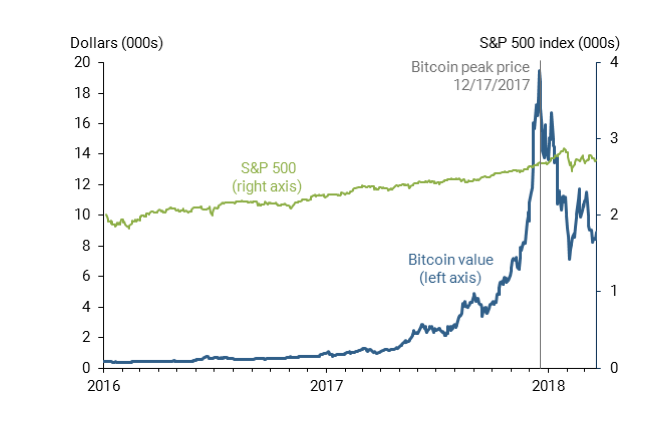

According to the paper, after Bitcoins launch in January 2009, the dollar price of a bitcoin remained under $1,150 until February 22, 2017, when it increased exponentially for about 10 months, as shown in Figure 1 (see above).

This explosive growth ended on December 17, 2017, when bitcoin reached its peak price of $19,511. Notably these dynamics aren’t driven by overall market fluctuations, as shown by comparison with the Standard & Poor’s 500 stock index.

CME’s Launch of Bitcoin Futures Coincides with the “Bitcoin Correction”

The peak bitcoin price coincided with the day bitcoin futures started trading on the Chicago Mercantile Exchange (CME).

2017 was the Year Cryptocurrencies Became Mainstream

After that date, it was all downhill where Bitcoin historically performs more poorly at the start of the year, a trend seen in years past as well.

The cryptocurrency rose more than 1,300% in 2017 as optimistic investors continued to bid up.

Even though Bitcoin is not tied to any tangible assets, altcoins inspite of the price correction continue to grow as the top altcoins emerge with complex relationships to the markets, that fluctuate largely in accordance with Bitcoin’s Price.

With increased regulation and bigger players trading in crypto, the price stability (as opposed to early volatility) should increase, in theory.

The paper continues, before December 2017, there was no market for bitcoin derivatives. This meant that it was extremely difficult, if not impossible, to bet on the decline in bitcoin price. Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination.

Since the crypto singularity, Bitcoin’s price appears to have stabilized around a price of $9,000.

Bitcoin’s “Speculative Betting” and it’s End

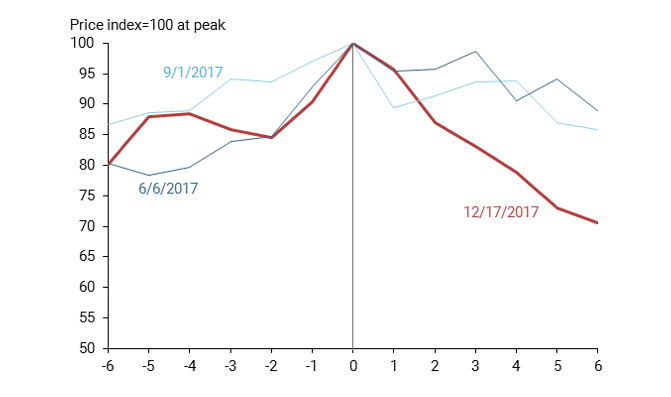

The one-sided “speculative demand” of Bitcoin and self-fulfilling prophecies came to an end when the futures for bitcoin started trading on the CME on December 17.

So while the Chicago Board Options Exchange (CBOE) had opened a futures market a week earlier on December 10, trading was thin until the CME joined the market. Thus here was finally a way to bet on Bitcoin without gambling with its digital store of value. Thus, this created a major price correction and a new trajectory of cryptocurrencies.

Bitcoin Futures Ended the Crypto Singularity

So according to the Federal Reserve Bank of San Francisco then:

The new investment opportunity led to a fall in demand in the spot bitcoin market and therefore a drop in price. With falling prices, pessimists started to make money on their bets, fueling further short selling and further downward pressure on prices.

6 months later, as of May, 2018 , the bitcoin price had not returned to its pre-futures peak.

So for Bitcoin’s fate as a store of value:

Given that there is no actual asset that backs the value of Bitcoin […] what will eventually determine the “fundamental” price of Bitcoin is transactional demand relative to supply.

(Michael K. Spencer is the original business insider. A tech Futurist and Editor of FutureSin. This post originated at Medium.com),

-cw