Citizen Advocates Demand Balanced, Transparent City Budget

LA WATCHDOG--One of the Priority Outcomes of Mayor Eric Garcetti s Back to Basics agenda was that the City of Los Angeles would “live within its financial means.”

But this is not the case.

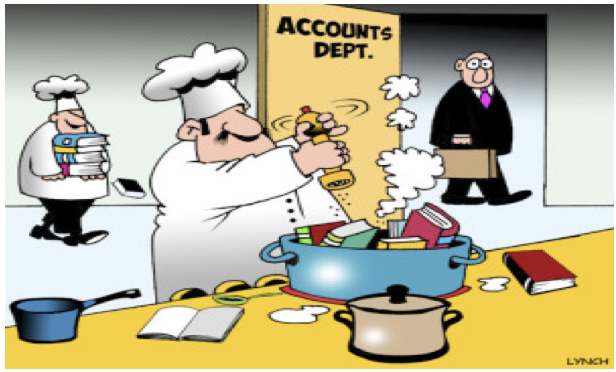

The City is grappling with a potential deficit of $245 million for this fiscal year that ends on June 30 and a budget gap of at least $250 million for the fiscal year that begins on July 1. This is despite revenues being up over $1 billion since Garcetti became Mayor.

These deficits are understated. They do not include adequate funds to repair and maintain our streets, sidewalks, parks, and the rest of our deteriorating infrastructure. They lowball the pension contributions that are determined using an overly optimistic investment rate assumption that “save” the City an estimated $500 million a year.

The impact of these deferrals is to dump an even larger financial burden on the next generation of Angelenos.

Projections for the next four years do take into consideration future salary increases for the police, civilian employees, and the firefighters.

It is not a pretty picture.

On March 8, the Budget Advocates, a volunteer group of citizens representing the charter authorized Neighborhood Councils, met with Mayor Garcetti and members of his budget team to discuss their annual White Paper and their “Back to Basics” Plan which includes the following recommendations.

- Develop and implement a seven-year operating and financial plan for the City. This is standard operating procedure for an enterprise with revenues of over $8 billion a year and 32,000 civilian and sworn employees.

- Address the Structural Deficit (where expenditures increase faster than revenues) by refraining from entering into any labor agreement or approving any new programs or initiatives that will result in future budget deficits.

- Require that ALL projects take into account the costs and savings over the entire life of the project, including ancillary costs and savings incurred by other City entities and stakeholders.

- Develop and implement a long-term plan to fix our streets along the lines of the Save Our Streets LA Measure that was proposed in April 2014.

- Implement a long-range plan to grow the City’s economy by developing new business friendly policies that encourage employers to move to LA or to remain and invest in LA.

- Benchmark the efficiency of the City’s departments and services and consider outsourcing projects to independent contractors.

- Appoint an experienced Chief Operating Officer/City Manager to oversee and coordinate the management of the City’s many departments and to improve their operating efficiency.

In addition, the Budget Advocates once again urged the Mayor and the City Council to implement the following excellent budget recommendations of the LA 2020 Commission that were endorsed by City Council President Herb Wesson at a well-attended press conference on April 9, 2014 at the California Endowment.

- Create an independent “Office of Transparency and Accountability” to analyze and report on the City’s budget, evaluate new legislation, examine existing issues and service standards, and increase accountability.

- Adopt a “Truth in Budgeting” ordinance that requires the City to develop a three-year budget and a three-year baseline budget with the goal of understanding the longer-term consequences of its policies and legislation.

- Establish a “Commission for Retirement Security” to review the City's retirement obligations to promote an accurate understanding of the facts and develop concrete recommendations on how to achieve equilibrium on retirement costs within five years. This Commission will also address the Buffett Rule and the investment rate assumptions of the pension plans.

Unfortunately, these recommendations that were designed to shine the sun on the City’s finances and operations have never seen the light of day.

In addition, the Budget Advocates have developed a list of revenue producing ideas for the General Fund. This resulted in a discussion about the specific suggestions and the City’s need for additional revenue to address our infrastructure, service levels, affordable housing, and services to the homeless.

The Budget Advocates also submitted reports on 26 of the City’s departments. They were based on numerous in person meetings with department heads that allowed the Budget Advocates to gain a better understanding of the departments and the overall operations of the City. These reports also contain recommendations specific to the departments.

The Mayor, recognizing the time, effort, and dedication of the Budget Advocates, will ask the City Administrative Officer and his budget team to report back on the White Paper and its findings and recommendations. Hopefully, this response will be shortly after the release of next year’s budget on April 20 so that Budget Advocates have ample time to prepare for the Budget and Finance Committee hearings on the budget.

The development of and the adherence to a long term operating and financial plan, the implementation of a Back to Basics Plan, the adoption of the recommendations of the LA 2020 Commission, the develop of new sources of revenue, and an improved business and investment environment will result in increased revenues for the City that will allow it to eliminate the Structural Deficit, to address its infrastructure needs, and to begin the proper funding of its pensions.

By increasing the transparency onto the City’s complex operations and finances and by implementing policies that require the City to “live within its means,” City Hall will begin the process of restoring Angelenos’ trust and confidence in its elected officials.

(Jack Humphreville writes LA Watchdog for CityWatch. He is the President of the DWP Advocacy Committee and is the Budget and DWP representative for the Greater Wilshire Neighborhood Council. He is a Neighborhood Council Budget Advocate. Jack is affiliated with Recycler Classifieds -- www.recycler.com. He can be reached at: lajack@gmail.com.)

-cw